(Adopted at the 25th meeting of the 7th Board of Governors on July 29, 2022; issued by Announcement [2022] No. 74 on August 31, 2022; effective as of December 1, 2022)

Chapter 1 General Provisions

Article 1 These Rules are made in accordance with the Trading Rules of Zhengzhou Commodity Exchange for the purposes of better managing the risks of futures trading, protecting the lawful rights and interests of the parties in futures trading, and ensuring the smooth conduct of futures trading activities at the Zhengzhou Commodity Exchange (the “Exchange”).

Article 2 Futures trading risks are managed through margin requirement, price limit, position limit, trading limit, the large trader reporting regime, forced liquidation, and the risk warning regime.

Article 3 The Exchange, Members, overseas brokers, and clients shall comply with these Rules. Each overseas broker shall assist its carrying futures brokerage Member (“FB Member”) in handling such matters as forced liquidation, large trader reporting, and risk warning. The FB Member shall promptly send to the overseas broker the Forced Liquidation Notice, results of forced liquidation, and risk advisories relating to the clients of the said overseas broker.

Chapter 2 Margin Requirement

Article 4 The Exchange implements margin requirements for futures trading.

The minimum Trading Margin requirements for the futures contracts of each product and for the different stages in a contract’s lifecycle are governed by the relevant product-specific rules.

Article 5 Trading Margin for the positions opened in a futures contract on the current day will be provisionally collected based on the prevailing margin rate and the contract’s settlement price on the preceding trading day. At daily clearing, Trading Margin for all positions in the contract will be collected based on the prevailing margin rate and the contract’s settlement price on the current day.

Article 6 If a futures contract enters a lifecycle stage that requires an adjustment to the Trading Margin rate, then Trading Margin for all positions in the contract will be collected based on the new margin rate starting from market close on the trading day before the first day of that stage.

Article 7 Where the cumulative increase or decrease (“N”), as calculated based on the settlement price, in the price of a futures contract over four (4) consecutive trading days (respectively denoted as D1, D2, D3, and D4) reaches three (3) times the price limit or the cumulative price increase or decrease over five (5) consecutive trading days (D1, D2, D3, D4, and D5) reaches 3.5 times the price limit, the Exchange will be entitled to raise the Trading Margin rate by no more than three (3) times of the prevailing rate.

N is calculated as:

N = (Pt - P0) / P0 × 100%, where t = 4, 5;

P0 is the contract’s settlement price on the trading day preceding D1; and

Pt is the contract’s settlement price on the trading day t (t=4, 5).

Article 8 In the event of an impending long market holiday due to the public holiday schedule, the Exchange may adjust the Trading Margin rates and price limits of futures contracts before the market closes for the holiday.

Article 9 Where the market risks associated with a particular futures contract have notably increased, the Exchange may, based on the level of market risks:

(1) restrict some or all of the Members, overseas brokers, and clients from making Funds Deposits and Funds Withdrawals;

(2) suspend some or all of the Non-FB Members and clients from opening or closing out positions;

(3) adjust the contract’s Trading Margin rate; and

(4) adjust the contract’s price limit.

The Exchange may unwind the above measures once the market for the futures contract stabilizes.

Any adjustment of the Trading Margin rate or of the price limit shall be publicly announced and filed with the China Securities Regulatory Commission (“CSRC”).

Article 10 Where two or more Trading Margin rate adjustments prescribed in these Rules are applicable to a futures contract, the highest of such rates shall prevail.

Chapter 3 Price Limit

Article 11 Futures trading is subject to price limit. The maximum permitted daily price movement of the listed futures contracts is set by the Exchange.

Where two or more price limit adjustments prescribed in these Rules are applicable to a futures contract, the largest of such price limit ranges shall prevail.

Article 12 The daily price limit of the futures contracts listed on the Exchange is set out in the relevant product-specific rules.

Article 13 The price limit of a new futures contract from the listing day to the day on which it is first executed is twice the price limit normally in effect.

On the trading day following the day on which it is first executed, the price limit will revert to the value normally in effect.

Article 14 Orders in a futures contract executed at the limit price will be matched and executed by close-out priority and time priority.

Article 15 A futures contract is in a “Limit-Locked Market” if, within the five (5) minutes before market close, there are only buy (sell) orders but no sell (buy) orders placed at the limit price, or that any buy (sell) order is instantly filled without deflecting the execution price away from the limit price.

Article 16 Where a Limit-Locked Market occurs to a futures contract on a particular trading day (denoted as D1, and the four (4) trading days thereafter are respectively denoted as D2, D3, D4, and D5), the price limit of the contract on D2 is set to three (3) percentage points above that on D1; the Trading Margin rate for the contract at time of clearing on D1 and for D2 is set to two (2) percentage points above the price limit on D2, unless the Trading Margin rate thus adjusted is lower than the rate in effect on D1, in which case the rate in effect on D1 applies.

If a same-direction Limit-Locked Market does not occur to the contract on D2, then the Trading Margin rate will revert to the normal level at time of clearing on that day and the price limit will revert to the normal level on D3; otherwise, the price limit on D3 will be set to three (3) percentage points above that on D2; the Trading Margin rate at time of clearing on D2 and for D3 will be set to two (2) percentage points above the price limit on D3, unless the Trading Margin rate thus adjusted is lower than the rate in effect on D2, in which case the rate in effect on D2 applies.

If a same-direction Limit-Locked Market does not occur to the contract on D3, then the Trading Margin rate will revert to the normal level at time of clearing on that day and the price limit will revert to the normal level on D4. If a same-direction Limit-Locked Market still occurs on D3 (i.e., a Limit-Locked Market occurs on three consecutive trading days in the same trading direction), the Exchange may, in view of market conditions, take any one of the following three measures with respect to the contract and publicly announce its decision:

Measure 1: Allow trading to continue on D4, possibly complemented by such risk control measures as adjusting the Trading Margin requirement, adjusting the price limit, suspending the opening of new positions, suspending the close-out of positions, requiring the close-out of positions, and other risk control measures.

Measure 2: Suspend trading on D4, possibly complemented by such risk control measures on D5 as adjusting the Trading Margin requirement, adjusting the price limit, suspending the opening of new positions, suspending the close-out of positions, requiring the close-out of positions, and other risk control measures.

Measure 3: Suspend trading and carry out forced position reduction on D4. Starting from the trading day following the day of forced position reduction, the Trading Margin rate and price limit for the contract on D3 will apply until the contract is no longer in a same-direction Limit-Locked Market.

Article 17 If a reverse-direction Limit-Locked Market occurs on D2 or any of the subsequent trading days, the Limit-Locked Market is deemed reset and that day is treated as the new D1. In this case, the price limit and Trading Margin for the following trading day will be set in reference to Article 16.

Article 18 “Forced position reduction,” with respect to a futures contract, refers to the process taking place at time of clearing on D4 whereby the Exchange automatically matches and executes, at the limit price on D3 and in accordance with the prescribed manner and method, all close-out orders submitted at the limit price and remaining unfilled at market close on D3 by clients (including here and hereinafter Non-FB Members) whose unit loss on its positions in the contract is greater than or equal to a certain percentage (namely, the minimum Trading Margin rate provided in the contract specifications) of the settlement price of the contract on D3, against the profitable positions in the contract.

The long and short positions held by a client in the futures contract will be automatically and mutually closed out before forced position reduction. Economic losses incurred by forced position reduction shall be borne by the relevant Members, overseas brokers, and clients.

Article 19 Forced position reduction is conducted by the following method and procedures:

(1) Determination of the Pending Liquidation Quantity

“Pending Liquidation Quantity” refers to the total size of all close-out orders submitted at the limit price and remaining unfilled within the Exchange’s computer system upon market close on D3 by all clients whose unit loss on its positions in the contract is greater than or equal to a certain percentage (namely, the minimum Trading Margin rate provided in the contract specifications) of the settlement price of the contract on D3. Where due to the mutual close-out of long and short positions, the positions held by clients are less than the foregoing size of the close-out orders, the computer system will automatically adjust the size of the close-out orders accordingly. Any client unwilling to close out its positions in the foregoing manner may cancel its orders before market close to exclude them from the close-out orders entering the liquidation process.

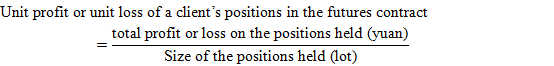

The unit profit or unit loss of a client’s positions is calculated as follows:

Where “total profit or loss on the positions held” refers to the total profit or loss, calculated according to the difference between the actual execution price and the current day’s settlement price, on all positions held by the client in the contract.

(2) Determination of the scope of liquidation for clients with profitable positions

All speculative positions (including arbitrage positions) held by the client with a unit profit, as well as the hedging positions held by the client with a unit profit greater than or equal to two (2) times the price limit provided in the contract specifications, in each case as calculated by the foregoing method, are included in the scope of liquidation.

(3) Principles and method for allotting the Pending Liquidation Quantity

(i) Principles for allotting the Pending Liquidation Quantity

(a) Pending Liquidation Quantity is allotted to positions within the scope of liquidation which are classified, by profitability and whether they are speculative or hedging, into four liquidation levels, in the following sequence:

Pending Liquidation Quantity is first allotted to speculative positions within the scope of liquidation with a unit profit greater than or equal to two (2) times the price limit provided in the contract specifications (“200+% Speculative Positions”);

then to the remaining speculative positions with a unit profit greater than or equal to one (1) times the price limit provided in the contract specifications (“100+% Speculative Positions”);

then to the remaining speculative positions with a unit profit less than one (1) times the price limit provided in the contract specifications (“0+% Speculative Positions”);

and finally to hedging positions with a unit profit greater than or equal to two (2) times the price limit provided in the contract specifications (“200+% Hedging Positions”);

(b) The allotment ratio for each of the four liquidation levels is equal to the ratio between the Pending Liquidation Quantity (or remaining Pending Liquidation Quantity) and the size of profitable positions available for liquidation at each liquidation level.

(ii) Method and procedures for allotting the Pending Liquidation Quantity

If the size of 200+% Speculative Positions is greater than or equal to the Pending Liquidation Quantity, then Pending Liquidation Quantity is evenly allotted for liquidation to the 200+% Speculative Positions at the ratio of the former to the latter;

If the size of 200+% Speculative Positions is less than the Pending Liquidation Quantity, then the 200+% Speculative Positions is allotted for liquidation to the Pending Liquidation Quantity at the ratio of the former to the latter, with the remaining Pending Liquidation Quantity allotted to the 100+% Speculative Positions in the same manner as above. The remaining Pending Liquidation Quantity, if there is still any, is successively allotted to the 0+% Speculative Positions and the 200+% Hedging Positions in the same manner. Any remaining Pending Liquidation Quantity after these steps will not be allotted any further. The specific method and procedures are set out in the appendix to these Rules.

The Pending Liquidation Quantity is allotted in unit of “lot.” In the event of fractional quantity, allotment is conducted in the following manner: First, allotment of the integer part of the Pending Liquidation Quantity allotted to each trading code; second, allotment of the fractional part to the trading codes, rounded up to a whole lot in each case, in the order of descending value of the fractional part for each.

Article 20 If the risks associated with the futures contract are not mitigated after the foregoing measures, the Exchange will declare a state of abnormality and take risk control measures in accordance with relevant rules.

Article 21 Where a newly listed contract experiences a Limit-Locked Market on or before the day it is first executed, the provisions of Article 16 on the price limit and Trading Margin rate do not apply.

If a futures contract experiences a third consecutive same-direction Limit-Locked Market on the Last Trading Day of its delivery month, then upon market close on that day, the Exchange may, based on market conditions, either carry out forced position reduction before delivery matching or proceed directly to delivery matching.

Chapter 4 Position Limit

Article 22 Futures trading is subject to position limit.

“Position limit” refers to the maximum size of speculative positions (calculated on a single-counted basis) in a given futures contract that a Member or client is permitted to hold by the Exchange.

Article 23 FB Members are not subject to the position limits for the futures contracts listed on the Exchange.

Article 24 The position limits for the futures contracts listed on the Exchange are as set out in the product-specific rules.

Article 25 Before market close on the last day of trading in the month preceding the delivery month of a futures contract, each Member and client shall adjust its positions in the contract to an integer multiple of the delivery unit. Upon entering the delivery month, the positions held by every Member or client in the contract shall be an integer multiple of the delivery unit.

Article 26 With respect to any client that has opened multiple trading codes through different FB Members, the aggregate positions held by the client through all such trading codes shall not exceed the position limit prescribed for a single client.

Article 27 The positions held by a Non-FB Member or client in a futures contract shall not exceed the position limit prescribed by the Exchange.

If such position limit is exceeded, the Exchange will take actions in accordance with the provisions of Chapter 7 “Forced Liquidation” of these Rules, and may additionally take such measures against the Non-FB Member or client as requiring a written explanation, issuing a written warning, arranging for a regulatory meeting, and restricting the opening of new positions.

Chapter 5 Trading Limit

Article 28 The Exchange enforces trading limit. “Trading limit” refers to the maximum position that a Member or client is permitted by the Exchange to open in a particular contract within a certain period. The Exchange may, in view of market conditions, establish trading limits for the various listed products and contracts and for some or all of the Members and clients, the specific levels of which will be separately announced by the Exchange.

The foregoing paragraphs of this Article do not apply to positions opened for hedging and market making purposes.

Article 29 With respect to any client that has opened multiple trading codes through different FB Members, the aggregate size of positions opened by the client through all such trading codes shall not exceed the trading limit prescribed for a single client.

Article 30 The positions opened by a Non-FB Member or client shall not exceed the trading limit prescribed by the Exchange. If such trading limit is exceeded, the Exchange may take such measures against the Non-FB Member or client as giving a reminder call, requiring a situation report, requiring a written undertaking, placing it on the supervisory watchlist, and suspending it from opening new positions.

Chapter 6 Large Trader Reporting

Article 31 Futures trading requires large trader reporting.

Any Non-FB Member or client whose positions in a particular futures contract have reached 80% or more of the position limit prescribed by the Exchange, or is otherwise requested by the Exchange, shall report its funds and position details to the Exchange. The Exchange may adjust the reporting threshold based on the level of market risks. A client shall submit the report through its carrying FB Member. Any client that engages in futures trading through an overseas broker shall submit the report through the overseas broker, who will forward the report to its carrying FB Member.

Non-FB Members and clients shall ensure the large trader reports and other materials they submit are truthful, accurate, and complete.

Article 32 Any Non-FB Member or client that meets the large trader reporting criteria during the course of trading shall voluntarily submit the report to the Exchange on the following trading day. The Exchange will notify the relevant Member if a second or supplementary report is needed following the initial report.

Article 33 Any Non-FB Member or client that meets the large trader reporting criteria shall submit the following materials to the Exchange:

(1) ZCE Large Trader Reporting Form;

(2) relevant account-opening documents and the current day’s settlement statement; and

(3) any other documents required by the Exchange.

Article 34 A FB Member or overseas broker shall conduct a preliminary review of the reporting materials provided by a client to ensure such materials are truthful and accurate.

Chapter 7 Forced Liquidation

Article 35 Futures trading is subject to forced liquidation.

“Forced liquidation” refers to the compulsory action taken by the Exchange to liquidate the non-compliant futures positions held by a Member or client for a violation of the relevant rules of the Exchange.

Article 36 The Exchange has the right to carry out forced liquidation against any Member or client that:

(1) lets its Trading Margin balance fall below zero (0) and fails to meet the margin requirement within the prescribed time limit;

(2) has exceeded its position limit;

(3) holds futures positions in the delivery month as an individual;

(4) is subject to the penalty of forced liquidation for a violation;

(5) should be subject to forced liquidation as an emergency measure taken by the Exchange;

(6) falls under any other circumstances that warrant the forced liquidation.

Article 37 The principles and procedures of forced liquidation are as follows:

Forced liquidation shall be carried out by the relevant Member first. Unless a different time limit is especially designated by the Exchange, failing to complete the forced liquidation by 10:15 a.m. entitles the Exchange to carry it forcibly.

In any forced liquidation carried out by a Member under Item (1), (2), or (3) of the preceding Article, the Member may solely determine the positions to be liquidated provided the results of forced liquidation comply with the rules of the Exchange. In any forced liquidation carried out by a Member under Item (4), (5), or (6) of the preceding Article, the positions to be liquidated will be determined by the Exchange.

Forced liquidation by the Exchange follows the procedures below:

(1) The Exchange carries forced liquidation in accordance with the liquidation list provided by the Member.

(2) If no liquidation list is provided by the Member and Item (1) of the preceding Article applies, forced liquidation will be carried out by descending size of the open interest of each futures contract as of market close of the preceding trading day and, with respect to each futures contract, by descending loss on the net positions of each client of that Member, until the Trading Margin balance meets the requirement of the Exchange. Forced liquidation involving multiple Members will be carried out by descending size of the margin call to each Member.

(3) If Item (2) of the preceding Article applies, forced liquidation will be carried out against the Non-FB Members or clients by descending size of their exceedance of the applicable position limit.

(4) If no liquidation list is provided by the Member and Item (3) of the preceding Article applies, forced liquidation will be carried out by descending size of the futures positions held by individuals as of market close of the preceding trading day.

(5) If no liquidation list is provided by the Member and Item (4), (5), or (6) of the preceding Article applies, forced liquidation will be carried out by the Exchange based on the specific circumstances of the Members and clients involved.

(6) If a Member simultaneously falls under the circumstances of Items (1), (2), and (3) of the preceding Article, the Exchange will determine the positions to be liquidated based on Items (2) and (3) first and Item (1) second.

Where market conditions make it infeasible to following the above principles and procedures, the Exchange has the right to carry out forced liquidation at its discretion.

Article 38 The Exchange shall notify the relevant Member, and the Member shall notify the relevant clients, for any forced liquidation carried out or to be carried out by the Exchange.

In the circumstances under Items (1), (2), and (3) of Article 36, the settlement results provided by the Exchange will serve as such notice. In the circumstances under Items (4), (5), and (6) of Article 36, the Exchange will issue a Forced Liquidation Notice to the Member.

Article 39 Where a Member fails to complete forced liquidation within the prescribed time limit, the remaining positions will be directly liquidated by the Exchange against the Member at the market price in accordance with the principles under Article 37.

Upon completing the forced liquidation, the Exchange shall send the results of forced liquidation to the relevant Members along with the current day’s transaction record, and shall archive the forced liquidation record.

Forced liquidation is carried out at the price established by market transactions.

Article 40 If forced liquidation cannot be fully completed on the current day due to price limit hits or other market factors, the remaining positions may be liquidated on the following trading day until all are liquidated.

Article 41 Where forced liquidation must be postponed due to price limit hits or other market factors, the resulting losses shall be borne by the relevant Members and clients. Where forced liquidation fails to be completed, the holder of the remaining positions continues to be liable for those positions and shall assume the relevant obligations of delivery.

Article 42 Profits and losses from forced liquidation shall be attributed to the holder of the relevant positions except for the circumstance under Item (4) of Article 36. Where the positions holder is a client, the losses from forced liquidation shall be first borne by its carrying Member who should then seek recovery from the client at its own initiative. Where the positions holder is a client of an overseas broker, the overseas broker shall assist its carrying FB Member to carry out the forced liquidation; any resulting losses shall be first borne by the FB Member who should then seek recovery from the overseas broker at its own initiative, upon which the overseas broker may do the same in relation to the client.

For any forced liquidation carried out under Item (4) of Article 36, any resulting losses shall be borne by the holder of the relevant positions and any profits shall be handled in accordance with the policies of the People’s Republic of China.

Chapter 8 Handling of State of Abnormality

Article 43 During the futures trading hours the Exchange will take emergency measures to mitigate risks, and may further declare a state of abnormality, in the event of:

(1) a disruption of such processes as trading, clearing, delivery, and option exercise and fulfillment due to such causes as earthquake, flood, fire or another force majeure event, computer system fault, or accident;

(2) a clearing, delivery, or option exercise and fulfillment crisis that is causing or will cause a material impact on the market;

(3) same-direction successive price limit hits for certain futures contracts and there is reason to believe that a Member, overseas broker, or client has violated the Trading Rules of Zhengzhou Commodity Exchange or its detailed implementing rules and such violation is causing or will soon cause a material impact on the market; or

(4) other situations specified by the Exchange.

In situation (1) above, the President of the Exchange may institute such emergency measures as adjusting the market opening or closing time; suspending trading; adjusting the trading hours; suspending the listing of new contracts; adjusting the Last Trading Day, expiration date, or Last Delivery Day of a contract or other relevant dates; adjusting the processes related to standard warehouse receipts and delivery; adjusting the exercise, fulfillment, or mutual close-out of option contracts; adjusting the Margin Collateral business; cancelling all relevant pending applications; adjusting the time of forced liquidation; adjusting the margin rate or collection method or the price limit; adjusting the settlement price or final settlement price; adjusting the rate and settlement time of relevant fees and charges; and adjusting the method of sending the clearing data. If situation (1) occurs and the relevant trading orders or transaction data are erroneous or become lost and unrecoverable, the President of the Exchange may order the cancellation of the relevant unfilled trading orders and the Board of Governors may order the cancellation of the relevant trades.

In situation (2), (3), or (4) above, the Board of Governors may institute such emergency measures as adjusting the market opening or closing time, suspending trading, adjusting the price limit, raising the Trading Margin requirement, suspending the opening of new positions, requiring the close-out of positions within a prescribed time limit, carrying out forced liquidation, restricting Funds Withdrawals, and carrying out forced position reduction.

Article 44 The Exchange shall file a report with the CSRC before declaring a state of abnormality and taking emergency measures.

Article 45 Where the Exchange declares a state of abnormality and suspends trading, the period of suspension shall not exceed three (3) trading days unless an extension is approved by the CSRC.

Chapter 9 Risk Warning

Article 46 The Exchange implements a risk warning regime for futures trading.

The Exchange may, whenever it deems it necessary, take one or a combination of the following measures to warn against and mitigate risks: requiring a situation report, arranging for a regulatory meeting, and issuing a risk advisory.

Article 47 Upon the occurrence of any of the following circumstances, the Exchange may hold a meeting with the relevant client or the officers of a Member or overseas broker to alert them to the relevant risks, or require a Member, overseas broker, or client to submit a situation report:

(1) any abnormal price movement in a contract;

(2) any abnormality in the trades of the Member, overseas broker, or client;

(3) any abnormality in the positions of the Member, overseas broker, or client;

(4) any abnormality in the funds of the Member;

(5) the Member, overseas broker, or client may have been involved in a violation or default;

(6) the Exchange has received a complaint involving the Member, overseas broker, or client;

(7) the Member or overseas broker is involved in an enforcement investigation; or

(8) any other circumstance recognized by the Exchange.

Risk alert given by telephone call shall be documented by audio recording, video conference by video recording, and face-to-face meeting by a transcript.

Where the Exchange decides to arrange for a regulatory meeting, the relevant Member, overseas broker, or client shall attend the meeting at such time and place and by such means as designated by the Exchange.

Where the Exchange requires a situation report, the relevant Member, overseas broker, or client shall give a truthfully report within such time limit, of such information, and by such means as designated by the Exchange.

Article 48 The Exchange may issue a risk advisory in writing to any Member, overseas broker, or client that is suspected of a violation or is exposed to substantial risks with its positions.

Article 49 The Exchange may issue a risk advisory to some or all of the Members, overseas brokers, and clients in the event of:

(1) any abnormality in futures prices;

(2) a major divergence between futures and spot prices;

(3) a major divergence between domestic and international futures prices; or

(4) any other circumstances recognized by the Exchange.

Chapter 10 Ancillary Provisions

Article 50 Any violation of these Rules will be handled in accordance with the Rules of Zhengzhou Commodity Exchange on Violations.

Article 51 The Exchange reserves the right to interpret these Rules.

Article 52 These Rules take effect on December 1, 2022.

Appendix:

Method and Procedures for Allotting the Pending Liquidation Quantity

|

Step |

Condition for Allotment |

Quantity for Allotment |

Allotment Ratio |

Targets of Allotment |

Result |

|

1 |

Size of 200+% Speculative Positions ≥ Pending Liquidation Quantity |

Pending Liquidation Quantity |

Pending Liquidation Quantity / Size of 200+% Speculative Positions |

Speculative clients with 200% unit profit or higher |

Allotment completed |

|

2 |

Size of 200+% Speculative Positions < Pending Liquidation Quantity |

200+% Speculative Positions |

Size of 200+% Speculative Positions ÷ Pending Liquidation Quantity |

Clients participating in the liquidation process |

Go to step 3 or 4 if not fully allotted |

|

3 |

Size of 100+% Speculative Positions ≥ Remaining Pending Liquidation Quantity 1 |

Remaining Pending Liquidation Quantity 1 |

Pending Liquidation Quantity 1 / Size of 100+% Speculative Positions |

Speculative clients with 100% unit profit or higher |

Allotment completed |

|

4 |

Size of 100+% Speculative Positions < Remaining Pending Liquidation Quantity 1 |

100+% Speculative Positions |

Size of 100+% Speculative Positions ÷ Remaining Pending Liquidation Quantity 1 |

Remaining clients participating in the liquidation process |

Go to step 5 or 6 if not fully allotted |

|

5 |

Size of 0+% Speculative Positions ≥ Remaining Pending Liquidation Quantity 2 |

Remaining Pending Liquidation Quantity 2 |

Pending Liquidation Quantity 2 / Size of 0+% Speculative Positions |

Speculative clients with unit profit higher than 0% |

Allotment completed |

|

6 |

Size of 0+% Speculative Positions < Remaining Pending Liquidation Quantity 2 |

0+% Speculative Positions |

Size of 0+% Speculative Positions ÷ Remaining Pending Liquidation Quantity 2 |

Remaining clients participating in the liquidation process |

Go to step 7 or 8 if not fully allotted |

|

7 |

Size of 200+% Hedging Positions ≥ Remaining Pending Liquidation Quantity 3 |

Remaining Pending Liquidation Quantity 3 |

Pending Liquidation Quantity 3 ÷ Size of 200+% Hedging Positions |

Hedging clients with 200% unit profit or higher |

Allotment completed |

|

8 |

Size of 200+% Hedging Positions < Remaining Pending Liquidation Quantity 3 |

200+% Hedging Positions |

Size of 200+% Hedging Positions ÷ Remaining Pending Liquidation Quantity 3 |

Remaining clients participating in the liquidation process |

No further allotment for any remaining quantity |

Notes:

1. Remaining Pending Liquidation Quantity 1 = Pending Liquidation Quantity – Size of 200+% Speculative Positions;

2. Remaining Pending Liquidation Quantity 2 = Remaining Pending Liquidation Quantity 1 – Size of 100+% Speculative Positions;

3. Remaining Pending Liquidation Quantity 3 = Remaining Pending Liquidation Quantity 2 – Size of 0+% Speculative Positions;

4. Size of speculative positions and hedging positions refers to the size of positions that are within the scope of liquidation and are held by clients that have recorded a net profit.

(This English version is for reference ONLY. In case of any inconsistency between the different language versions, the Chinese version prevails.)